When a person dies without a valid Will, they are considered to have died intestate. Dying intestate means a person has died without a Will or has left a Will that does not properly dispose of their property.

In NSW, intestacy laws will determine who administers the deceased’s estate and how the deceased’s assets are distributed. The rules of intestacy are legislated under Chapter 4 of the Succession Act 2006 (NSW).

Who is eligible to inherit from an intestate estate?

The Succession Act sets out which relatives are eligible to inherit from an intestate estate. Examples of eligible parties and their entitlements are outlined below:

| Relative category | Entitlement to the estate |

|---|---|

| The current spouse and children from the relationship. | The current spouse is entitled to the whole estate unless the deceased has children from previous relationships. |

| The current spouse, children from the relationship, and children of the deceased from previous relationships. | The current spouse is entitled to:

- A statutory legacy, which amount changes from year to year. If the estate does not cover this, the spouse inherits the whole of the estate. - Half of whatever is left of the estate. - The remaining half of the estate is shared equally between all of the surviving children. |

What is the order of inheritance when someone dies intestate?

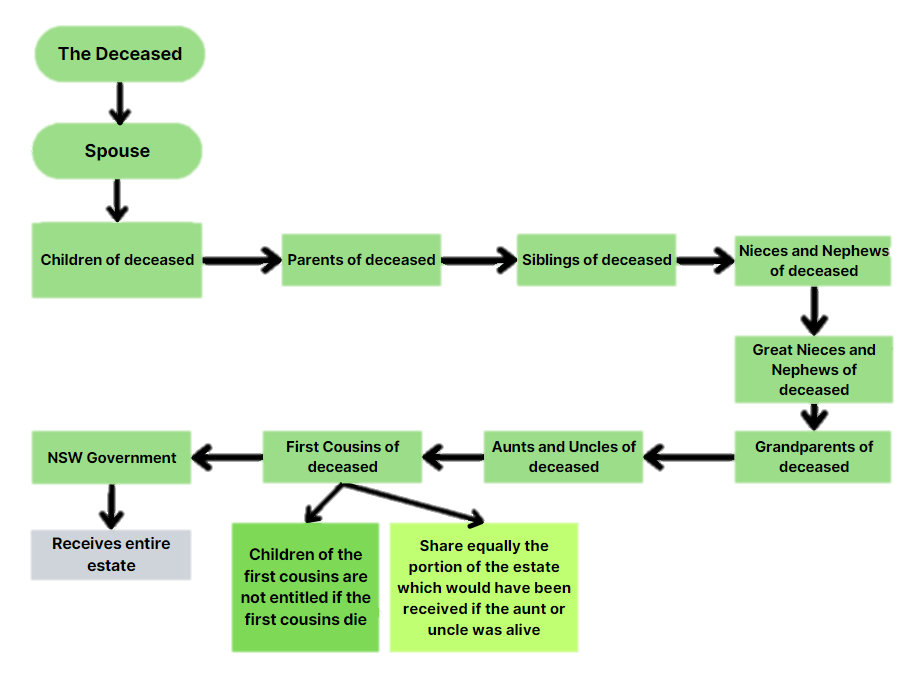

The statutory order in which eligible relatives will inherit an intestate estate is outlined in the diagram below:

Each “category” of relatives entitled to an intestate estate must be exhausted before moving on to the next. Once an eligible relative is found, the process stops. Each relative in the category receives an equal share of the estate (although there are exceptions for first cousins).

What is included in an intestate estate?

An intestate estate includes real estate owned by the deceased and also extends to other assets including:

- Vehicles

- Bank accounts

- Stock or bonds

- Personal effects (e.g. Jewellery, art, antiques)

What are Letters of Administration and how are they used to administer an intestate estate?

Letters of Administration is an order made by the Supreme Court of NSW that appoints an eligible person to administer an intestate estate.

Only a person who is entitled to the whole, or share, of the estate may apply for Letters of Administration. The administrator of an estate is responsible for gathering the deceased’s assets, repaying their liabilities and distributing their estate.

If there is no spouse or next of kin, the Court will grant administration to the NSW Trustee & Guardian or any other person the Court deems fit.

Applications for Letters of Administration must occur within six months from the date of death.

Notice of intended application for the administration of an intestate estate

A Notice of intended application must be lodged with the Court at least 14 days prior to applying for Letters of Administration. This notice allows eligible persons to make a claim on the estate or come forward with knowledge of an existing Will.

How does the administrator distribute an intestate estate?

Once the Letters of Administration has been granted, the administrator will hold the estate as a ‘trustee’ for the relevant beneficiaries. It is the administrator’s responsibility to pay any debts owed by the deceased from funds of the estate.

A Notice of intended distribution may also be published by the administrator prior to distributing the intestate estate. This notice allows creditors to make claims on the estate within 30 days. Although this notice is not mandatory, it may offer the administrator protection from personal liability.

NB: Gifts of money (legacy) must be distributed to the beneficiaries within 12 months otherwise interest can be claimed by the beneficiary against the estate.

Contact Us

If you wish to draft a Will or apply for Letters of Administration, we recommend that you seek professional advice. To discuss your estate matter with an experienced Wills & Estates lawyer, please contact Etheringtons Solicitors in North Sydney on (02) 9963 9800 or via our online contact form.